Green debt surges as investors bet on renewable energy growth

By Abbas Nazil

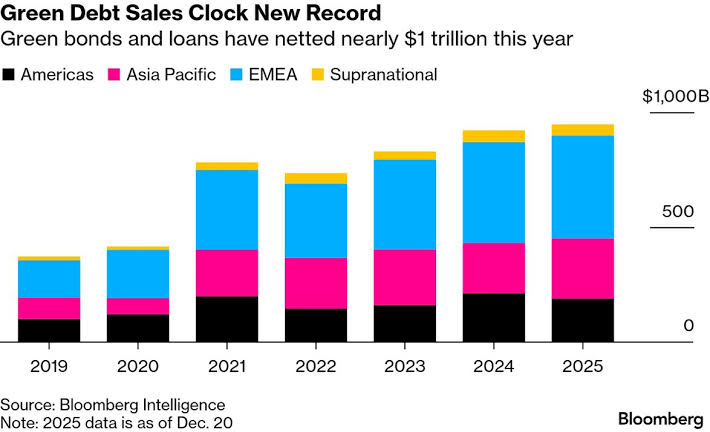

Global sales of green bonds and loans have reached record levels in 2025 as investors continue to pour money into climate-friendly assets despite political and regulatory setbacks in major economies.

Data compiled by Bloomberg Intelligence show that green debt issuance has climbed to about 947 billion dollars so far this year, underscoring sustained confidence in renewable energy and clean infrastructure investments.

The surge has come even as the United States and parts of Europe roll back clean-energy subsidies and environmental regulations, reflecting a disconnect between policy headwinds and investor behaviour.

Investor enthusiasm has been fuelled largely by rising demand for energy infrastructure driven by artificial intelligence, electrification, and cooling needs, which are expected to push global electricity demand up by nearly four per cent.

Renewable energy stocks have also outperformed broader markets, with clean-energy indices posting their first annual gains since 2020 and beating the S&P 500 by a wide margin.

Power-grid technology companies and renewable developers have benefited from being increasingly viewed as core infrastructure plays with predictable revenues rather than niche environmental investments.

Market analysts say capital is flowing toward sectors with strong structural demand, clearer policy backing, and long-term visibility, particularly grid upgrades and renewable power linked to electrification.

The resilience of green finance is notable in a year when US President Donald Trump openly backed fossil fuels and dismantled several clean-energy incentives.

Europe has also softened some of its toughest environmental rules amid concerns over slowing growth and declining competitiveness.

Despite these challenges, Asia-Pacific has emerged as a major driver of green debt growth, with companies and government-linked issuers raising about 261 billion dollars, a rise of roughly 20 per cent from last year.

China led the region with a record 138 billion dollars in green bond issuance, supported by its largest lenders and reinforced by a debut sovereign green bond sale in London.

India has also played a growing role, backing renewable energy expansion and emerging as a hotspot for clean-energy public listings.

This year, 11 Indian renewable energy companies raised more than one billion dollars through initial public offerings, while several others are seeking billions more.

Green bonds have continued to attract lower borrowing costs, particularly in Asia-Pacific, where some issuers benefited from discounts of more than 14 basis points for using green labels.

Major banks such as BNP Paribas and Credit Agricole have dominated green bond underwriting, reflecting strong institutional participation.

Over the past five years, the amount of outstanding green bonds has grown at an annual rate of about 30 per cent and now accounts for more than four per cent of total global bond issuance.

Easing US interest rates and refinancing needs could lift global green bond sales to as much as 1.6 trillion dollars next year, according to asset managers.

Not all segments have shared equally in the boom, with US green debt issuance falling seven per cent and sustainability-linked debt sales dropping sharply amid greenwashing concerns.