COVID-19: FG/IFAD-VCPD train 960 farmers on financial literacy in Niger

The Federal Government and International Fund for Agricultural Development (IFAD) Value Chain Development Programme (VCDP) in Niger said that it had trained 960 farmers on financial literacy.

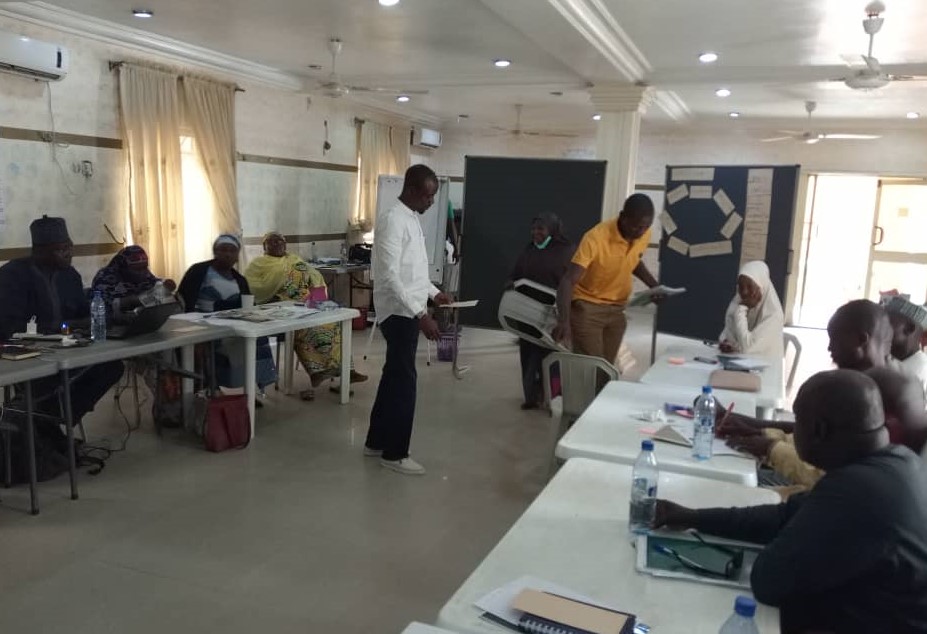

Hajiya Maimuna Ahmed, VCDP Rural Institution Gender and Youth Mainstreaming Officer in the state disclosed this in Minna during a two day training of the trainers (TOT) on financial literacy and linkage to micro-finance institutions.

Ahmed said that the TOT and beneficiary farmers was in response to the negative impact of the coronavirus (COVID-19) pandemic.

She said that re-training of the 48 trainers who have trained the beneficiary farmers at the rural level was to ensure that they are subject matter specialist in financial literacy and linkage to micro-finance institutions.

The VCDP Official added that the programme has the target of training additional 2,400 farmers before the end of November in order to bring the farmers to manage their agri-businesses satisfactorily.

According to Ahmed, “before the commencement of the VCDP in Niger state in 2015, 95 per cent of the farmers had no bank account.

“The five per cent that operated bank accounts, had dormant accounts. You will find out that before the VCDP, the farmers can hardly figure out what they had injected into their agri-businesses and what they had benefitted.’’

Ahmed said that the implication was that the farmers were operating at a loss due to lack of farm records.

The VCDP Official said that there are 25,453 VCDP farmers which comprised of producers, processors and marketers in the state.

She said that the farmers are operating under 1,271 cooperative societies spread across eight local government areas of Bida, Katcha, Kontagora, Shiroro, Wushishi, Edati, Mokwa and Borgu in the state.

Similarly, Mr Abubakar Musa, Consultant Facilitator to VCDP in the state, said that the trainers were trained on financial literacy for farmers, personal financial management, farm financial management and saving.

Other aspects of the training included credit for growth, risk management and insurance, investment and financial service providers.

Miss Christiana Kolo, one of the trainers, said that the exercise was interactive and educative on how best to train the beneficiary farmers on financial literacy.

“The training afforded us the best method to pass the message on how the farmers will manage their finances in order to boost their agri-businesses,’’ she said.